universal life insurance face amount

The face value or face amount of a life insurance policy is established when the policy is issued. In the first the death benefit equals the face value of.

5 Types Of Life Insurance Policygenius

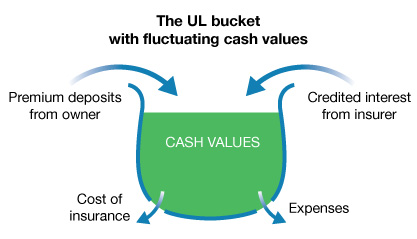

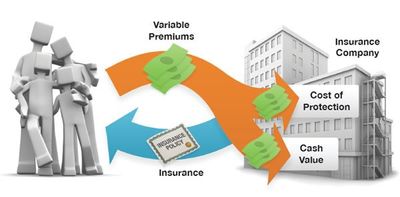

It allows for a greater degree of flexibility and often lower cost than whole life insurance another popular.

. The cash value within a whole life insurance policy builds at a fixed rate. Universal life insurance option 2. Key Factors to Consider When Making Changes.

This is often far more easily accomplished. The amount of money that has accumulated is known as the cash value of the whole life policy. Face Amount is the amount of life insurance that a policy owner purchases.

The death benefit represents the insurance companys value promises to payout when. What is the disadvantage of universal life insurance. Policy Change Request Type.

This Policy Change content is for Term Life products issued between 2013 to 2017. A Policy may increase or decrease the. With a universal life insurance policy you can select one of two death benefit options.

With whole life insurance neither your premiums nor your death benefit ever changes. One Year Term OYT Guaranteed Level Term GLT 10 15 20 30. Which of these features are held exclusively by variable universal life insurance.

At the beginning of the life insurance policy the face value and the death benefit value are the same. The downside of this option is that you pay premiums on the full face value for the life of the policy regardless of. Variable life insurance and Universal life insurance are very similar.

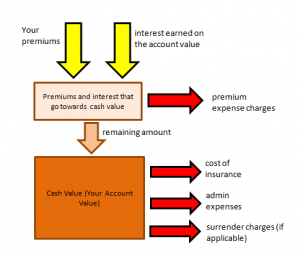

Under the terms of the policy the excess of premium payments above the. Universal life insurance allows policy owners to rather easily make adjustments to the death benefit or face amount of their policies. The actual death benefit paid on a death claim could differ from the face amount due to death.

Only permanent life insurance policies such as whole life and universal life. Universal Life Insurance A universal life insurance policy allows the change of the face amount and the premium amount. Universal life insurance is a type of permanent life insurance.

Solved Jonathan Has A Universal Life Insurance Policy With A Face Value Of 500 000 The Current Cash Value Of The Policy Is 11 260 Jonathan Wants To Stop Paying Premiums For A

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

Term Life Vs Universal Life Insurance

Division Of Financial Regulation Universal Life Premium Life Insurance And Annuities State Of Oregon

Difference Between Term Universal And Whole Life Insurance Infographic

Any Reason To Keep This Universal Life Policy Bogleheads Org

Universal Life Insurance Ultimate Guide To Benefits Pros Cons

4 Life Insurance Questions Fidelity

Universal Life Insurance Royalty Associates

What Is The Face Value Of Life Insurance Bankrate

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

Term Vs Whole Life Insurance What S The Difference

Glossary Of Life Insurance Terms Smartasset Com

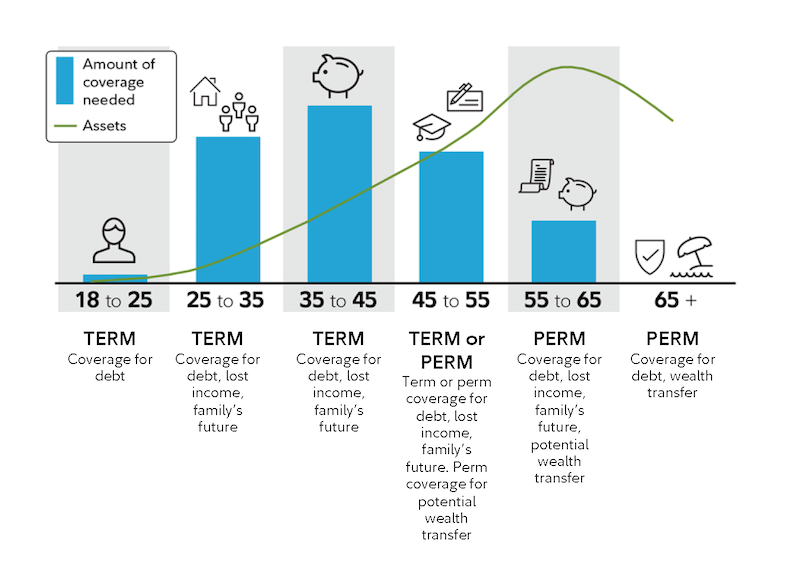

Term Vs Permanent Life Insurance Should You Convert Cwb Wealth Management

Variable Universal Life Accumulator Pdf Free Download

What Are Paid Up Additions Pua In Life Insurance

Universal Life Insurance Announcing Huge Premium Increase What Can You Do

5 Disadvantages Of Indexed Universal Life Insurance Know Your Options